We were at the GIIN Impact Forum in Berlin last week to network with inspiring asset owners and managers in times where impact investing is under pressure in some parts of the world.

GIIN just published its 2025 State of the Market report and here are some of the main take-aways:

🔹Resilience of Impact Assets Amid Market Slowdown

Despite a global capital pullback and slower economic growth, impact assets have shown resilience. Impact AUM has grown at a compound annual rate of 21% over six years, even if the growth slowed recently.

🔹Strong Preference for Market-Rate Returns

79% of impact investors seek risk-adjusted, market-rate returns representing 89% of impact AUM targeting market-rate returns.

🔹Private Markets Dominate Impact Investing

73% of impact investors focus on private markets. Private equity and private debt are the most common instruments, with 74% of investors making at least one allocation through private equity and 49% through private debt.

🔹Sector Focus: Energy, Agriculture, and Healthcare Lead

Energy (20% of impact AUM) and financial services (21%) are top sectors. Over half of investors plan to increase allocations to energy (56%), agriculture and forestry (48%), healthcare (37%), and water/sanitation (36%) in the next five years.

🔹Geographic Concentration in High-Income Regions

70% of impact AUM is invested in high-income regions, especially Northern America and Western Europe.

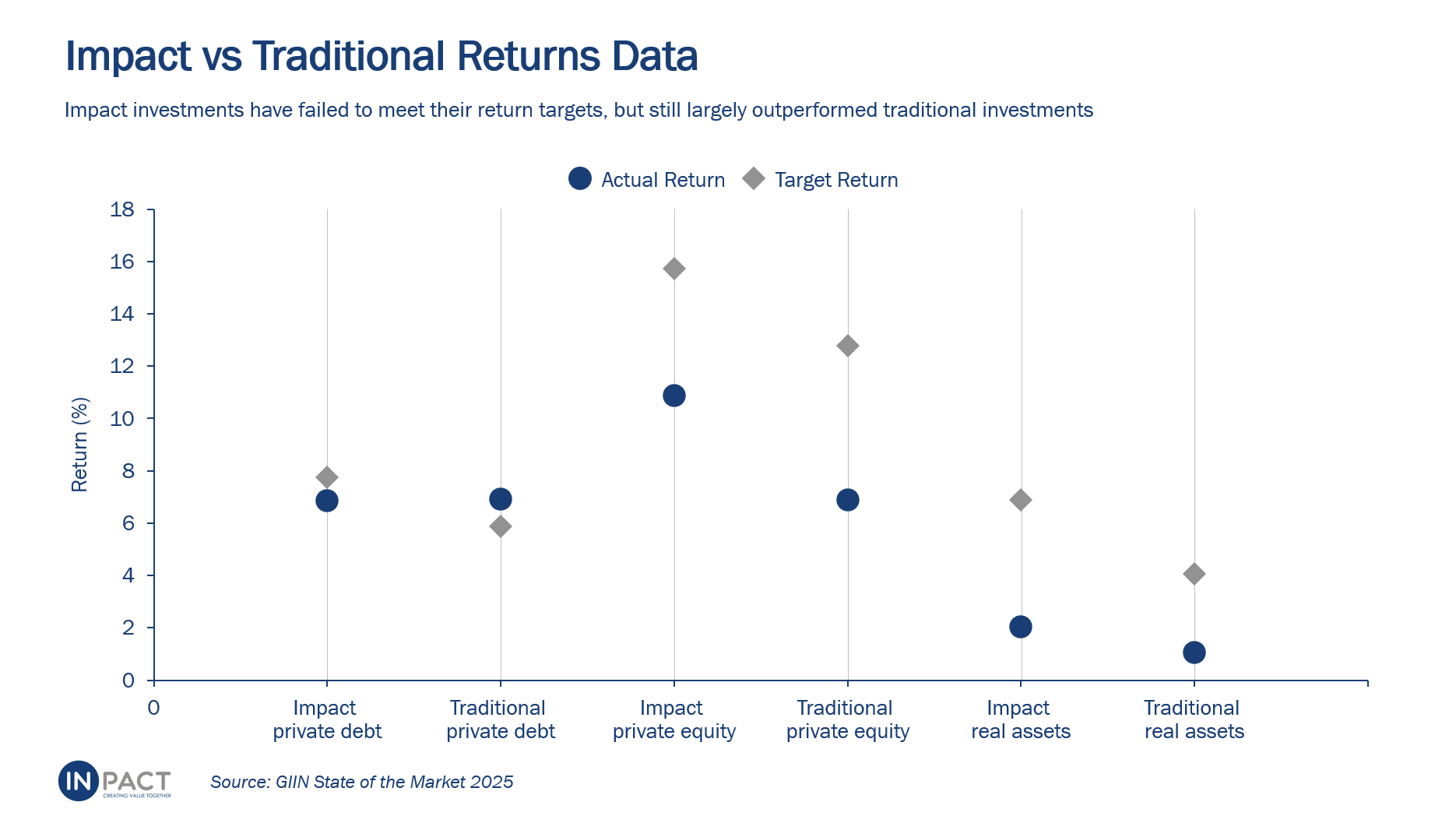

🔹Performance and Satisfaction: Impact Outpaces Financial Returns

90% of investors are satisfied with their impact performance, but only 72% with financial performance. Impact investments outperform traditional assets in actual returns across nearly all asset classes (see chart).

🔹Challenges: Impact-Washing, Data Quality, and Macroeconomic Pressures

62% of investors see impact-washing as a challenge for the industry. Data collection (time, cost, verification) and macroeconomic issues (inflation, interest rates, downturns, climate change) are top concerns. ESG backlash is rising, especially in the US.

🔹Generational Opportunity and Call to Action

Impact investors are well-positioned to address global challenges, especially as official development assistance declines. There is a generational opportunity to drive impact investments further.